Pay off debt while building wealth and becoming financially free

A unique method to eliminate your debt in about 1/3 of time using inefficent money

What type of debt can be paid off?

Credit Cards

Student loans

Mortgage

Auto loans

Personal Loans

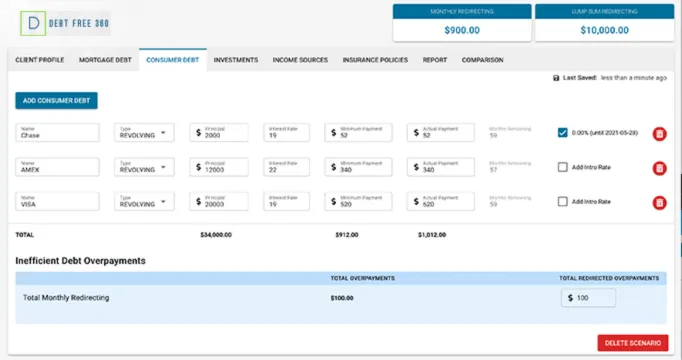

How does Debt Free 360 work?

For individuals who are paying their bills on time and contribute to a savings or retirement account, Debt Free 360 is a unique way to pay off your debt utililizing our software and a specialized High Cash Value Whole Life Insurance Policy

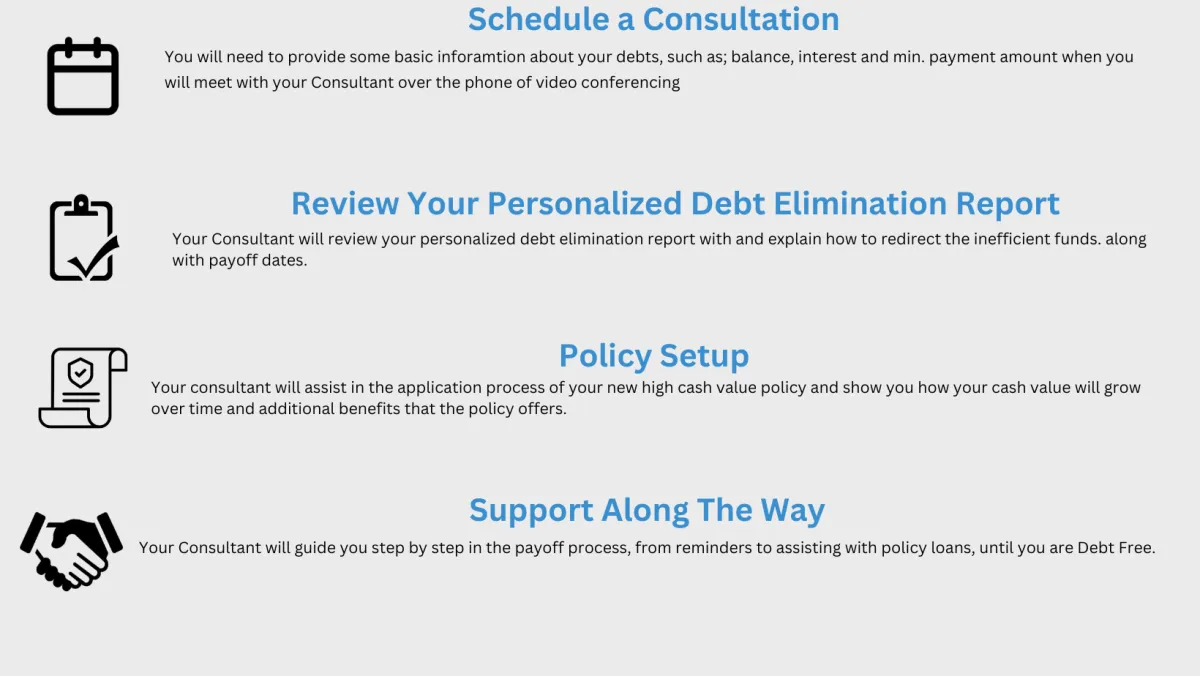

How To Get Started?

A Personalized Debt Elimination Report

Your report will contain so much value information and insight regarding your debt situation.

You will learn how by redirecting inefficient funds into a high cash value life insurance policy can get you debt free in about 1/3 of the time of your current payoff method.

The most exciting part is you will know when you will be debt free and how much interest you will save at the end.

Oh yeah, did we mention your personalized report and consultation is FREE.